If you are trading stocks you NEED to know the terms below. I have had people try to argue why they should never learn the terms used for trading stock, and it is an argument I have never understood.

If you are trading stock, you are doing yourself a disservice by not understanding what stock is and how it is traded. This guide is stock trading 101, and a must read for anyone who trades stock.

What is stock?

Stock is ownership of a company. Companies are started by individuals, usually with their own money. When the company grows beyond a certain point, the owners may consider selling part of their company to the public. They can sell 1% of the company, or all of it.

The process is heavily regulated, and a lot of information is required about the company. Certain financials, and other documents are required. Something called an IPO (initial public offering) is released, and after that the stock is publically traded.

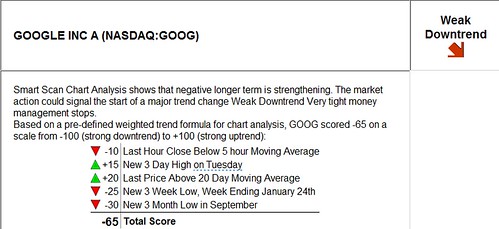

The stock price will vary based off of how well the company is doing, and general economic news. This is because the stock price is determined by basic supply and demand. Thousands of people look at the company information, the economic landscape and make decisions to buy the stock or sell the stock based on this information.

If they think the company's next big announcement will generate a large amount of revenue, they will buy as much stock as they can. If they think the company's headed for failure, they will sell to the next bidder.

Selling Stock is a Marketplace

When stock sells there is a buyer and a seller. In order to sell your stock, you need to find a buyer. In order to buy stock, you need to find a seller. When a price is quoted, most people will look at what is called the last price. The last price is the last trade between a buyer and selling. However, there are people who put open orders (called limit orders) out there to buy or sell a stock.

Ask Price

If someone wants to sell a stock at $10, this is called the ASK. If they are the best offer out there for a stock, the ask will be listed as $10. If you pull up a stock quote you can see what I am referring to. Yahoo finance is a great source for updated quotes. GE is a great stock to use as an example.

If you want to sell you stock, the current ask price is your competition. If you are buying, the ask price is probably what you will pay if you place your order right away.

Bid Price

If someone wants to buy a stock, the offer is called a BID. So if I wanted to buy a stock at $9 it would be listed as a bid for $9. If that is the most anyone wanted to buy it for, it would be listed on the stock quote under bid for $9.

So let's say the best bid was $9 and the best ask was $10. No trades are going to take place until someone is willing to sell for less, or someone is willing to buy for more.

Those are very basic terms. Most brokerage firms have stock brokers that you can talk to who will explain it in a little more depth, and whom you can talk to for free.

When trading stock, it is not so simple that a baby can do it, there really is a lot more to it than that.

More from Associated Content:

Bookkeeping for Non-Profits

Social Media Guidelines for Educators

All the Resources You Need to Start a Non-Profit in Colorado

stock promoters